Increasing one’s credit score can seem challenging, but in reality, it isn’t so hard. There are five ways to improve a credit score.

A good credit score is fundamental to so many things as people get older. From leasing a car to getting a mortgage, a credit score can determine one’s fate pretty quickly.

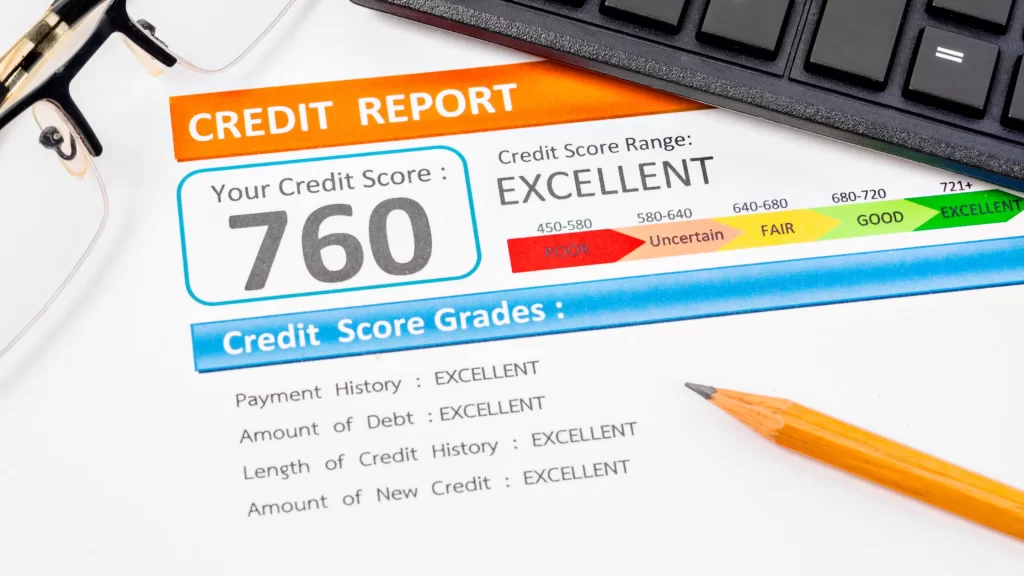

Everyone’s score is determined by four factors: payment history, amount of debt, length of credit history, and amount of new credit. Increasing one’s credit score can seem challenging, but in reality, it isn’t so hard.

There are five ways to improve a credit score…

#1: Add a new credit card/take out a new loan

As mentioned above, one of the factors affecting a credit score is the amount of credit someone has. A good rule of thumb is usually to have at least two credit cards to give the score a boost.

Furthermore, it is important to avoid taking out new loans or cards if there’s a bigger objective in the near term, such as a mortgage.

While taking out new debt decreases credit scores right away, those scores will jump to new peaks after a few months assuming all payments are being made on time. Hence, the suggestion not to take on more debt if there’s something bigger a person wants to apply for in the near future.

It takes time for the score to lift up again. Only take out new debt if there are no other loans that are going to be applied for in the next 3-5 months.

#2: Pay off credit card debt as soon as it’s posted

The amount of debt is the second most important category for determining someone’s credit score. As a result, people should try to make their debt balances zero as soon as possible.

On the other hand, there are people who believe their balances should be paid once their statement arrives. Although this strategy works, it allows the debt balance on people’s statements to extend longer. Thus, it can be seen as a sign of needing more time to repay the debt.

If people pay their balances on their cards as soon as they are posted, the debt gets wiped out immediately. It looks good to credit agencies, signaling that the person has the capacity to pay off their debt quickly. Plus, it makes it seem like there is rarely a substantial amount of debt, boosting one’s credit score.

The catch with paying debt as soon as it is posted is that it needs to be done consistently. If one month someone pays their debt right away but the next, they wait until the last day, it looks bad.

People should allow themselves enough time to consistently pay off their debt around the same amount of time. If it takes five days to repay the debt comfortably, then five days is when it should be paid every time.

If a person can’t afford to pay their balance so quickly, it shouldn’t be done to begin with.

#3: Utilize all cards appropriately

When people have several credit cards, it is important to use them all. It doesn’t matter if some cards have only $20 worth of debt on them.

Using all the credit cards available and paying off the balances in a timely manner is a sign of strong credit. Credit agencies like to see people who are able to take on more debt and handle it responsibly.

In addition, when people have multiple credit cards but only use one, it can be interpreted as someone not being capable of having more than one source of debt. As a result, someone’s score can be negatively affected. A good tip to follow is to use one card for bills and the other cards for other expenses like dining out and shopping.

#4: Allow first card to reach at least three years of age

Many people will say that it is vital to get a credit card as young as possible. In fact, those people are correct. As noted earlier, one factor that plays into a credit score is the length of someone’s credit history. The longer someone has had debt, the higher the score can be.

Typically, someone who has had a credit card for about eight or more years will begin to feel the benefits of their credit history length. However, people with a length of as early as two and a half years can already experience scores in the 780s or above. This is due in large part to paying off debt as soon as it is posted and having two cards available.

#5: Increase card limit and maintain same level of spending

Increasing one’s credit limit goes hand in hand with the amount of credit someone has. It serves as a signal to credit agencies that someone has the capacity to take on more debt.

Rather than going nuts with an increased limit, people should keep their spending consistent under the new limit. It is a way of demonstrating the responsibility someone has with their debt.

Above all, it creates a larger margin of what someone uses and the amount of debt they have remaining. This looks really good on a credit report and makes credit agencies very comfortable with the person.

All in all, it really isn’t too difficult to boost a credit score. As long as someone pays their balances on time, and early when possible, the rest falls into place on its own. The length of credit history takes care of its own.

Emphasis should be placed on consistent payments and consistent spending to boost a credit score. Apply for new credit if possible, and soon enough, those scores will be looking great.